Venture Capital (VC) are inherently risky as they come in a stage when a company is ideating, prototyping or scaling to solve a problem. This makes every investment a moon shot opportunity. One sector that has been gaining more attention from the VC word is the Fintech. This is evident from the fact that while we are seeing record numbers of unicorns: 959 across the globe, up from 569 in 2020, the hottest sector is fintech, which accounts for 15% of these firms.

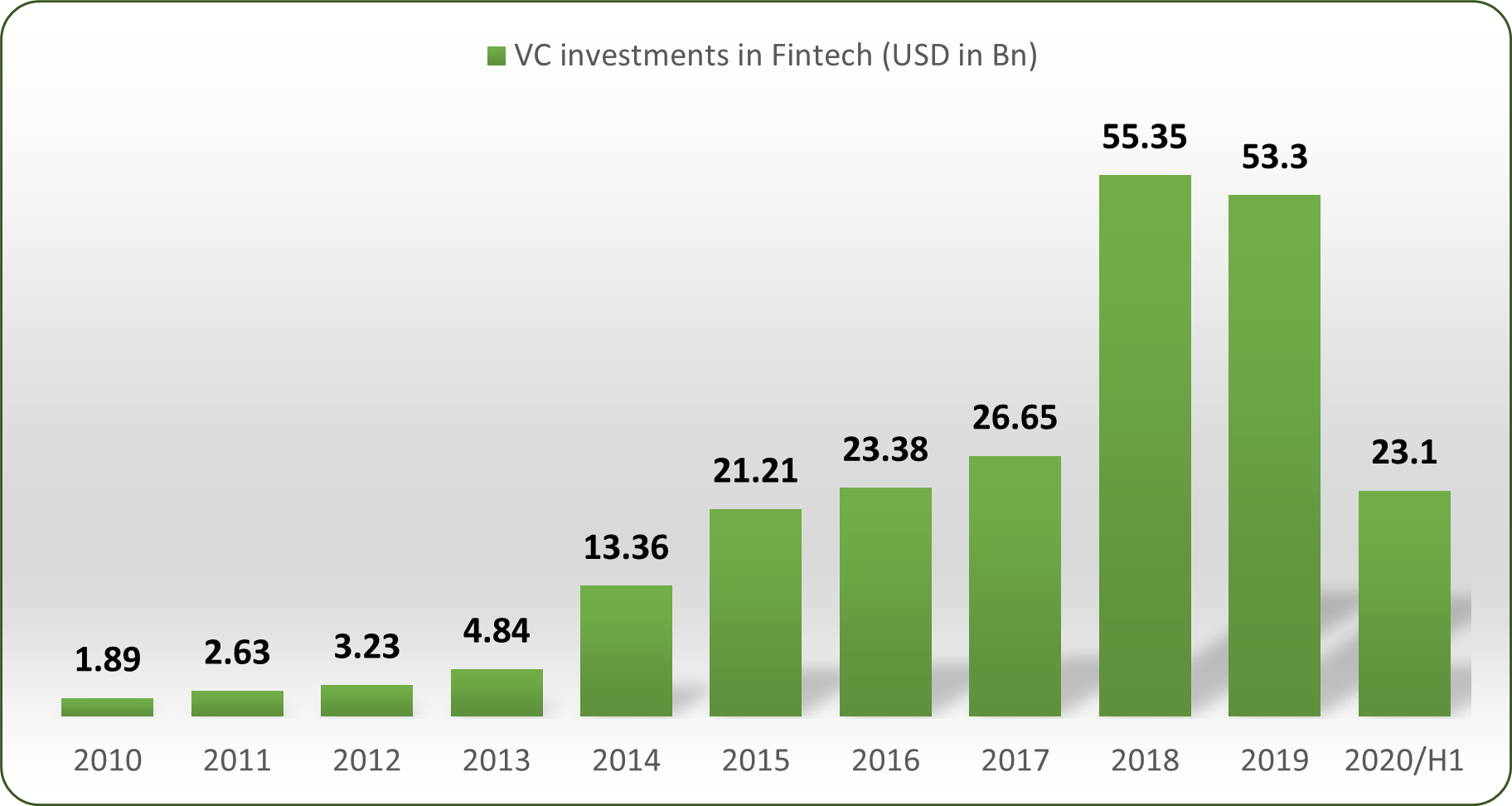

Growth of VC Investments in Fintech

During the last decade, overall investments in Fintech firms have grown rapidly, reaching over 1 trillion dollars.

The following indicators fully describe the picture of investments in Fintech firms. In 2010, the share of the capital raised by Fintech firms in the value of global equity deals was less than 1%. By 2020, this percentage reached 5%. In terms of numbers, in 2021, VC investments account for approximately 30% of all Fintech equity funding. In 2010, this was only 13%.

The growth of VC investments in Fintech companies over the recent decade paints the following picture.

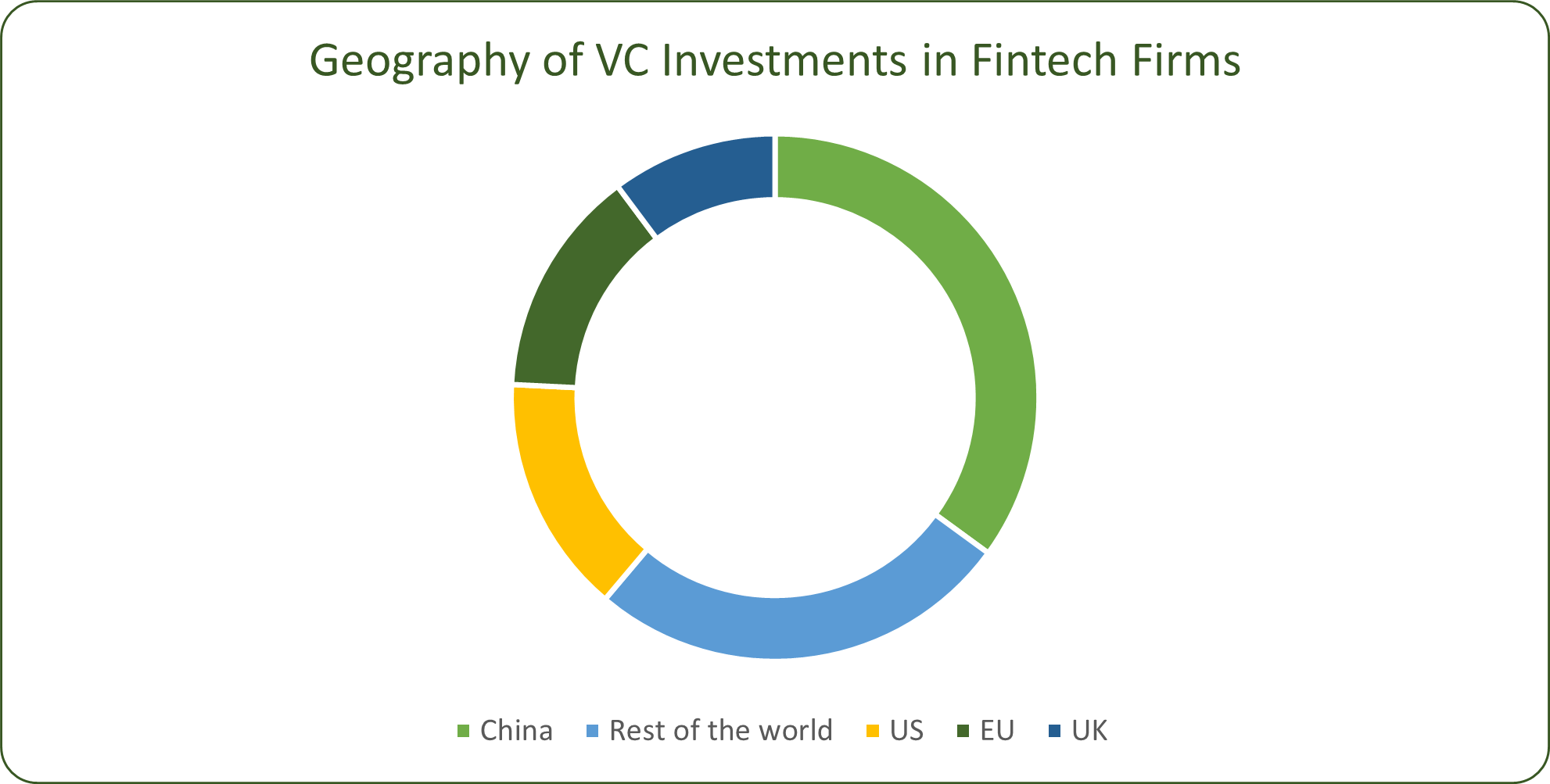

Geography and Market Segmentation of VC Investments in Fintech

Research shows that VC investments tend to grow in countries that have favorable regulation for innovation and have developed financial markets. In terms of geographical distribution, the leading country has been is China due to its higher innovation as well as a very accepting young population for

Fintech disruption.

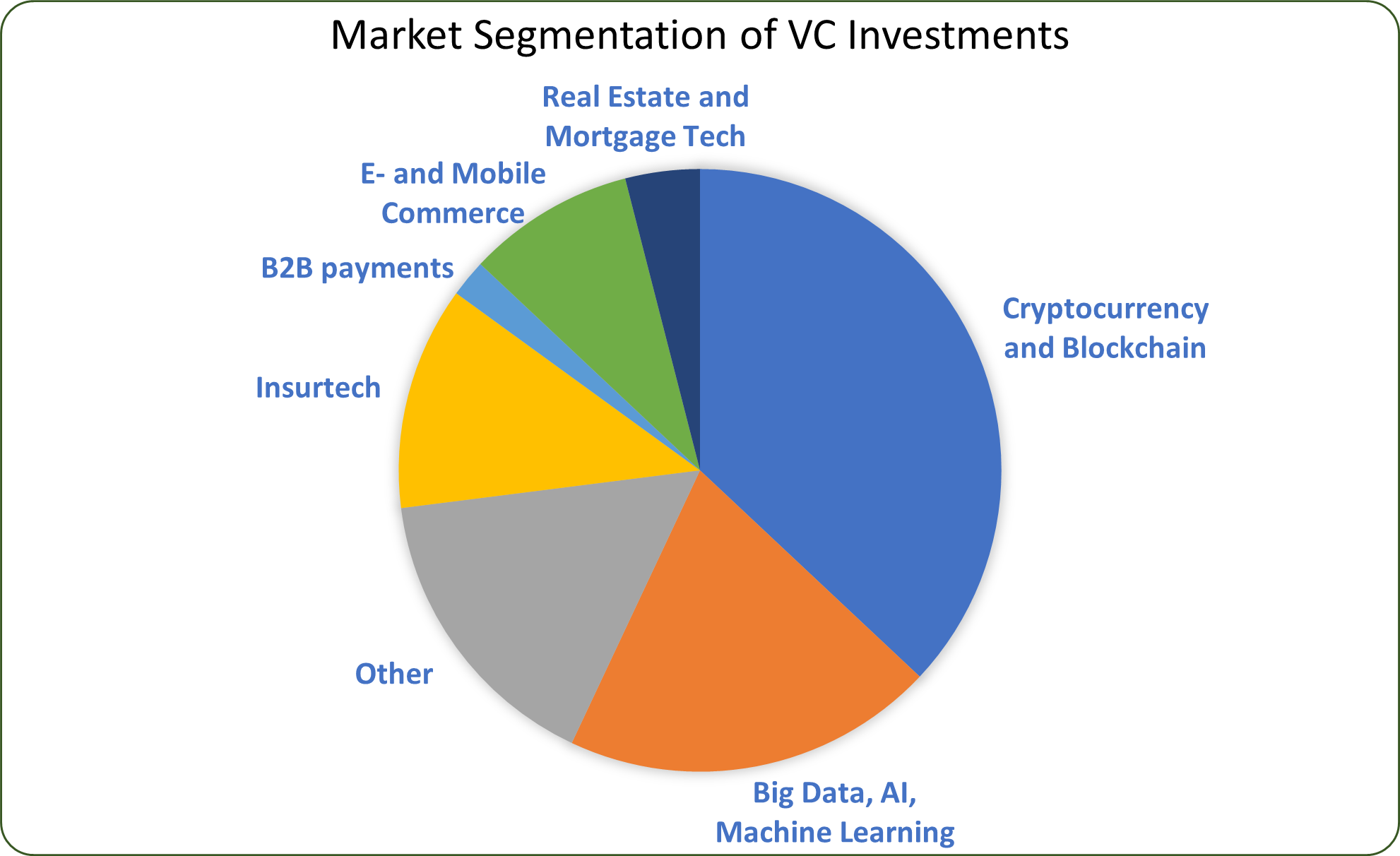

The most popular segments that attract investors are “Cryptocurrency and Blockchain”, “Big data, AI & Machine Learning” and “Insurtech”.

Drivers of VC investments in Fintech

The above presented pictures show that there are huge differences across countries. For example, in 2019, the level of funding of Fintechs was less than 0.01% of GDP in Russia; in Switzerland, this indicator reached 0.06% (close to 2% in UK). These differences are explained by the drivers, which

boost VC investments, in particular.

1. Capacity for Innovation

The capacity for innovation is the main driver that affects the development of Fintech and VC investments. Innovation capacity of a country may include resources such as creation of knowledge, development of high-tech experts, etc.

2. Level of Development of Financial Markets

Research shows that the more developed the financial markets are, the more VC investments are generated in Fintech. From this point of view, the leading countries are US and UK.

3. Better regulatory framework (including regulatory sandboxes) Sandboxes are a type of innovation facilities established by regulators. They provide a controlled testing environment for innovative financial products. After the testing period, the regulator decides whether to allow the product to go live or no. Research shows that availability of promotional regulation including

sandboxes is positively correlated with VC investments in Fintech.

Factors Affecting the VC Investments in Fintech:

Now, let’s see what factors investors consider when making investment decisions.

1. Impact on society

Investors usually prefer investing in projects that have longer-term social impact and solve problems that need to be addressed at a societal scale.

2. Covering market gaps

Targeting underserved markets, unreached market participants and opportunities to increased financial inclusion

3. Using technology to bring scaling cost down

All opportunities that bring down the cost of scaling, using technology are a must. Disruption in brick and mortar banking; lending; financial inclusion etc. are some areas that can be disrupted using technology as a cost advantage.

Dominor continues to focus on fintech as a sector with investments in companies such as KNAB finance, Orange Retail, Credit Enable to name a few…